- Equities

- Derivatives

- Market Insight

- Capital Markets

- Prime Services

- Outsourced Trading

- Commission Management

Mr. Andrew Volz

"Trusted global coverage by a team of industry professionals that allows our clients to focus on their investment decisions, while we focus on their trading."

Prime Services

JonesTrading Prime Services offers hedge fund firms a suite of capabilities that frees managers' time and energy so they can build their franchises and provide their investors with the institutional grade capabilities that are expected in today's competitive performance environment.

High Touch Trading

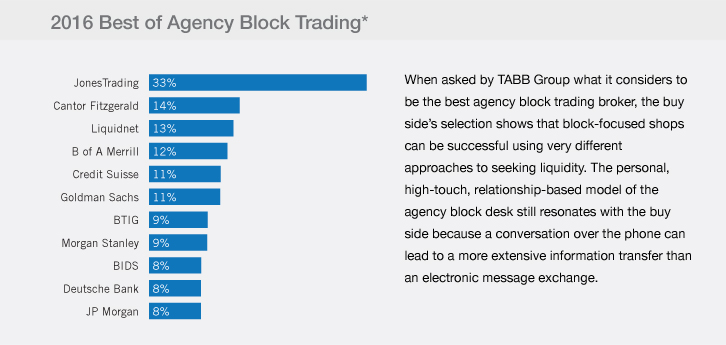

Our clients benefit from our relationship-based model, a network of knowledge - knowing our clients, their needs, and the trades they need executed. As portfolio managers and traders seek to gain performance in an increasingly difficult environment, JonesTrading brings the ability to source liquidity in tough-to-trade situations, to execute according to client intent, strategy, and style, and to do so at advantageous prices. For uncrossed orders we are agnostic on technology, so we route to the most appropriate electronic venues and algorithms to aid in securing opportunities for the best possible execution for each client. Additionally, our clients can access the international footprint and global reach of JonesTrading's equity trading expertise in over 45 countries, as well as listed options trading in the US and Canada.

Electronic Trading

For clients who prefer to work their own low touch orders, we offer RealTick and Market Trader along with full integration into all major OMS providers.

Top Tier Custodian

Broadcort Clearing (a division of Merrill Lynch, Pierce, Fenner & Smith Inc.). A #1 Institutional Clearing Counterparty with over 35 markets supported.

Securities Financing

We offer clients a wide variety of financing options including: Regulation T and Portfolio Margin across Equities, Options, and Fixed Income Asset Classes.

Leading Edge Technology

JonesTrading Prime Services has integrated the Nirvana reporting platform which consolidates and manages data across multiple asset classes, funds, accounts, traders, prime brokers, and custodians in a single integrated platform. Through Nirvana, we offer cloud based OMS, PMS and risk management and reporting solutions. JonesTrading has partnered with and integrated top tier execution management systems to offer our clients for their execution management and market data needs.

Capital Introduction

We take a refreshingly unique approach to Capital Introduction by focusing on the types of investors who have the resources and mandates to allocate to new/emerging managers, as well as more established funds. We help our clients by introducing investors focused on their fund's particular stage and strategy.

Mr. Andrew Volz

Managing Director, Head of Prime Services

Andrew Volz serves as Managing Director, Head of Prime Brokerage Services for JonesTrading based out of the New York office. Prior to JonesTrading, Andrew spent 6 years at Wells Fargo Prime Services, a technology focused Prime Services firm that Wells Fargo acquired in 2012, previously known as Merlin Securities.

JonesTrading Prime Services

Mr. Andrew Volz

"Trusted global coverage by a team of industry professionals that allows our clients to focus on their investment decisions, while we focus on their trading."